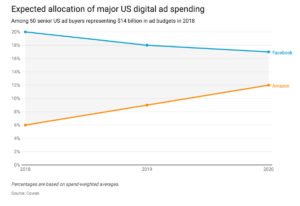

Amazon could double its ad revenue among top US ad buyers in the next two years, giving it 12 percent of total digital ad spending in 2020. Meanwhile, Facebook’s main social network platform is expected to lose three percentage points of market share in that time.

That’s according to a new Cowen survey of 50 senior US advertising buyers in late December that showed Amazon is expected to gain more digital ad market share by 2020 than any other platform.

These ad buyers controlled a total of $14 billion in digital ad budgets in 2018. The investment bank weighted the data so that bigger spenders factored in accordingly.

Ad buyers are mostly pulling their growing Amazon spend from other digital platforms, the survey found.

Google and YouTube are also expected to lose a modest amount of ad revenue share through 2020. Facebook-owned Instagram is expected to see a two percentage point increase in that time, helping to balance out its parent company’s loss. Still Facebook is particularly vulnerable, thanks to its recent spate of privacy issues.

Of the 50 ad buyers, 18 percent said privacy concerns would lead to decreased ad spend on Facebook, more than any other platform, according to the Cowen survey.

But it’s also likely Facebook’s stagnating daily active user growth in the US and Canada— its most valuable markets — is at least as big a factor as its myriad privacy mishaps.

Facebook has been warning investors for years that it has maxed out the number of ads it can put into its core Facebook app. A few of its other big properties, like Messenger and WhatsApp, don’t yet generate meaningful revenue.

Meanwhile, Amazon has been increasingly stuffing its search results with ads as it beefs up its ad business. The ad buyers ranked Amazon third for return on investment, after Google Search and Bing. Advertisers praised the conversion rates on Amazon, since it’s the only one of the top advertising platforms that can directly connect ads to purchases on the same page.

Of course, Facebook is still the top venue after Google for total US digital ad spending, controlling 20 percent of the market in 2018, according to eMarketer. Amazon, on the other hand, held just under three percent.

However, the habits of the top ad buyers will have an outsized affect on which platform succeeds — the $14 billion in ad budget among those surveyed is more than half of Facebook’s annual US ad revenue — so it’s important to pay attention to which way they’re leaning.

Source: Recode

You must be logged in to post a comment Login