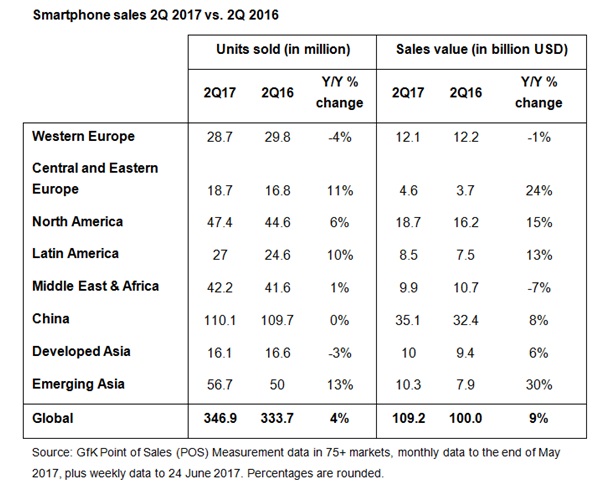

Global smartphone demand totalled 347 million units in 2Q17, up four percent year-on-year, marking the strongest second quarter on record, according to new research.

Global smartphone demand totalled 347 million units in 2Q17, up four percent year-on-year, marking the strongest second quarter on record, according to new research.

The study, from GfK, indicates that emerging Asian countries led the demand growth with a 13 percent year-on-year increase, followed by Central and Eastern Europe at 11 percent, and Latin America at 10 percent. Market value grew nine percent year-on-year, due to rising average sales price (ASP).

Key findings:

- Smartphone demand of 347 million units makes 2Q17 the best second quarter on record

- Emerging markets are driving the growth

- Average sales price (ASP) grew five percent year-on-year in the quarter

Arndt Polifke, global director of telecom research at GfK, comments, “The record demand for smartphones in the second quarter this year shows that, despite saturation in some markets, the desire to own a smartphone is a worldwide phenomenon. How that manifests itself differs widely by region. Manufacturers are maximizing all their creativity to ensure their latest devices are irresistible – and to increase ASP as a result. Elsewhere, macroeconomic factors and consumer confidence are having an impact, but operators and retailers are employing localized tactics to ensure the smartphone remains the connected device of choice.”

Western Europe: Demand drops for a third consecutive quarter

Smartphone demand totaled 28.7 million units in 2Q17, down three percent year-on-year. This is the third consecutive quarter of decline, caused by saturation in the largest markets, Germany, Great Britain and France. In these markets year-on-year demand fell -4 percent, -5 percent and -7 percent respectively. However, GfK expects major device launches in 4Q to help moderate full-year declines to -0.4 percent.

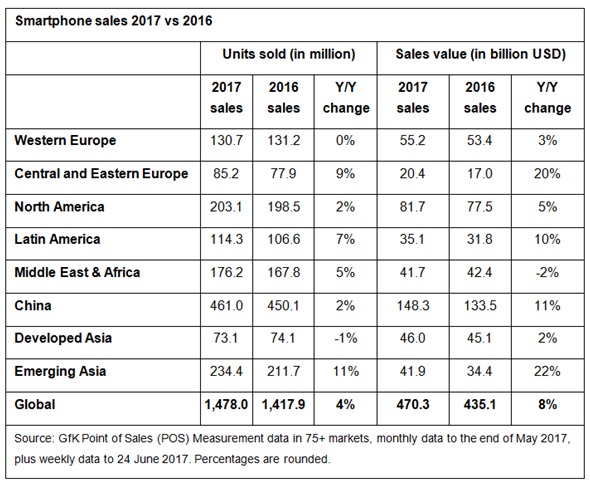

Central and Eastern Europe: Growing, and with a positive outlook

The region continues its recovery, with smartphone demand reaching 18.7 million units in 2Q17, up 11 percent year-on-year. As the political situation stablizes and consumer confidence recovers in Russia and the Ukraine, both markets have posted impressive year-on-year growth. In Russia, demand was up 11 percent year-on-year in 2Q17, and in the Ukraine it was up 22 percent. GfK raised its forecast for smartphone demand in the region slightly to 85.2 million in 2017, a rise of nine percent year-on-year.

North America: A welcome return to growth

Here, the market grew six percent year-on-year to 47.4 million units in 2Q, following falls in demand in the recent quarter. GfK forecasts smartphone demand in the region to total 203 million units in 2017, a rise of two percent year-on-year.

Latin America: Demand grows despite economic uncertainty

Smartphone demand in the region rose 10 percent year-on-year to 27 million units in 2Q17. This recovery is driven mainly by pent-up demand for smartphones in Brazil. Despite the uncertain political and economic environment, demand for smartphones in the country increased 15 percent year-on-year in the second quarter. GfK maintains its optimistic outlook for Latin America in 2017, forecasting smartphone demand to increase by approximately seven percent year-on-year.

Middle East and Africa: Macroeconomic weakness weighs on growth

Smartphone demand totaled 42.2 million units, up just one percent year-on-year. The slowdown in growth is largely due to macroeconomic weakness in the region and device saturation in the Middle East. Egypt in particular is experiencing very high inflation. Demand here declined four percent year-on-year in 2Q, while GfK forecasts a fall of 10 percent in 2017. However, this is a large and diverse region and GfK forecasts its overall smartphone demand to grow five percent year-on-year in 2017. Growth will come primarily from those Sub-Saharan and South African countries where smartphone penetration is still relatively low.

China: The market plateaus

In China, smartphone demand plateaued in 2Q17 at 110.1 million units, showing no change year-on-year. This moderation of growth in demand for smartphones was caused primarily by saturation in the market. However, as we’re seeing in other regions, higher-priced new products are pushing up market value. GfK forecasts smartphone demand in China to total 461 million units in 2017, an increase of two percent year-on-year. The growth in value terms (USD) is expected to be considerably higher, at 11 percent year-on-year.

Developed Asia: South Korea drags down the region

Overall smartphone demand totaled 16.1 million units in 2Q17, down three percent year-on-year. Declining demand in South Korea, which saw impressive growth last year, offset the increased demand in both Japan (up 12 percent year-on-year) and Australia (up nine percent year-on-year). GfK expects the region to experience a slight improvement in demand in the second half of 2017, finishing the full year down one percent. That will equate to 73.1 million units.

Emerging Asia: Anticipating the strongest regional growth in 2017

Smartphone demand in the region totaled 56.7 million units, up 13 percent year-on-year. Bangladesh and Malaysia powered most of this growth. In Bangladesh, smartphone demand grew by a strong 40 percent year-on-year. Malaysia is maintaining a steady recovery from its 2015 slump, and here demand in 2Q17 grew by 31 percent year-on-year. Smartphone demand in India also remained resilient in 2Q17, having leveled out slightly to 14 percent year-on-year. GfK expects the recently announced Goods and Services Tax (GST) will have no impact on smartphone demand in the country. GfK forecasts overall smartphone demand in the region will total 234 million units in 2017, an increase of 11 percent year-on-year. This represents the strongest growth across all regions for the year.

Yotaro Noguchi, product lead in GfK’s trends and forecasting division, adds, “Consumers are willing to pay more for their smartphone as they seek a better user experience. Despite the market reaching high penetration levels, GfK forecasts smartphone demand will continue to see year-on-year growth even in 2018, as innovation from smartphone vendors keeps replacement cycles from lengthening.”

Yotaro Noguchi, product lead in GfK’s trends and forecasting division, adds, “Consumers are willing to pay more for their smartphone as they seek a better user experience. Despite the market reaching high penetration levels, GfK forecasts smartphone demand will continue to see year-on-year growth even in 2018, as innovation from smartphone vendors keeps replacement cycles from lengthening.”

Methodology

GfK asked over 22,000 consumers (aged 15 or over) online in 17 countries how often they entertain guests in their home, selecting from: Every day or most days; At least once a week; At least once a month; Less often; Never.

Fieldwork was completed in summer 2016. Data are weighted to reflect the demographic composition of the online population aged 15+ in each market. The global average given in this release is weighted, based on the size of each country proportional to the other countries.

Countries covered are Argentina, Australia, Belgium, Brazil, Canada, China, France, Germany, Italy, Japan, Mexico, Netherlands, Russia, South Korea, Spain, UK and USA.

Source: Net Imperative

You must be logged in to post a comment Login